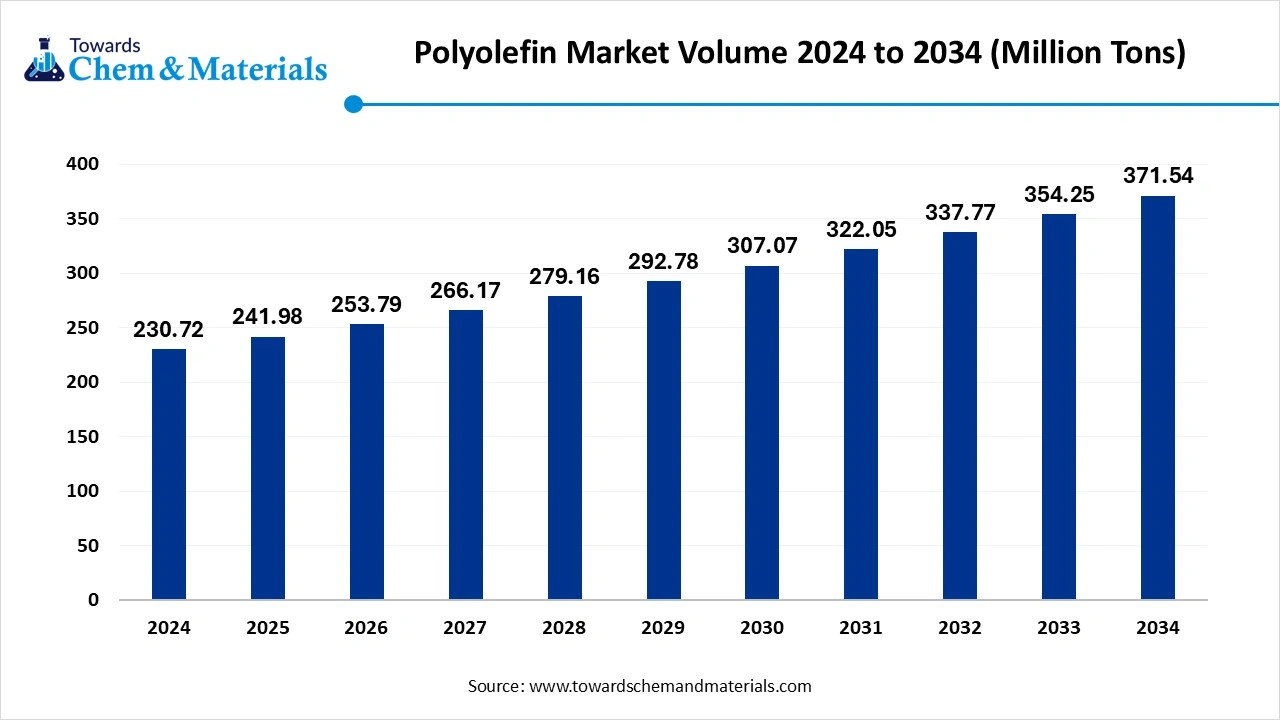

Polyolefin Market to Grow at CAGR of 4.88% Reaching 371.54 Million Tons by 2034

According to Towards chem and Materials consultants, the global polyolefin market volume reached 241.98 million tons in 2025 and is forecast to witness steady growth, touching nearly 371.54 million tons by 2034 at a CAGR of 4.88% from 2025 to 2034. Asia Pacific dominated the Asia Pacific fertilizers market with volume Share of 51.78% in 2024.

Ottawa, July 09, 2025 (GLOBE NEWSWIRE) -- According to a new Research Report, the global polyolefin market volume was approximately 230.72 million tons in 2024 and is expected to reach almost 371.54 million tons by 2034, a study published by Towards chem and Materials a sister firm of Precedence Research.

Get All the Details in Our Solutions –Download Sample: https://www.towardschemandmaterials.com/download-sample/5596

The ammonia market is witnessing growth driven by its critical role in green hydrogen production, increasing agricultural demand, and expanding industrial decarbonization initiatives globally.

Polyolefins are a group of polymers that are derived from simple olefins such as ethylene and propylene (with polyethylene (PE) and polypropylene (PP) being the two most used). Polyolefins are lightweight, chemically resistant, and durable which is why they are required for use in many industries with core applications in packaging, automotive, construction, and healthcare. The polyolefin market continues to grow globally as more application areas develop and the demand for more sustainable and recyclable plastic alternatives rises.

Catalyst technology innovation and societal shifts toward circular economy focused practices are driving change in the production of polyolefins, and bio-based and recycled polyolefins are trending products as firms look to minimize their environmental impact. In addition, there are ongoing modifications and other processing methods which enhance polymer product performance to facilitate further product usage in more high performance applications.

Key Takeaways

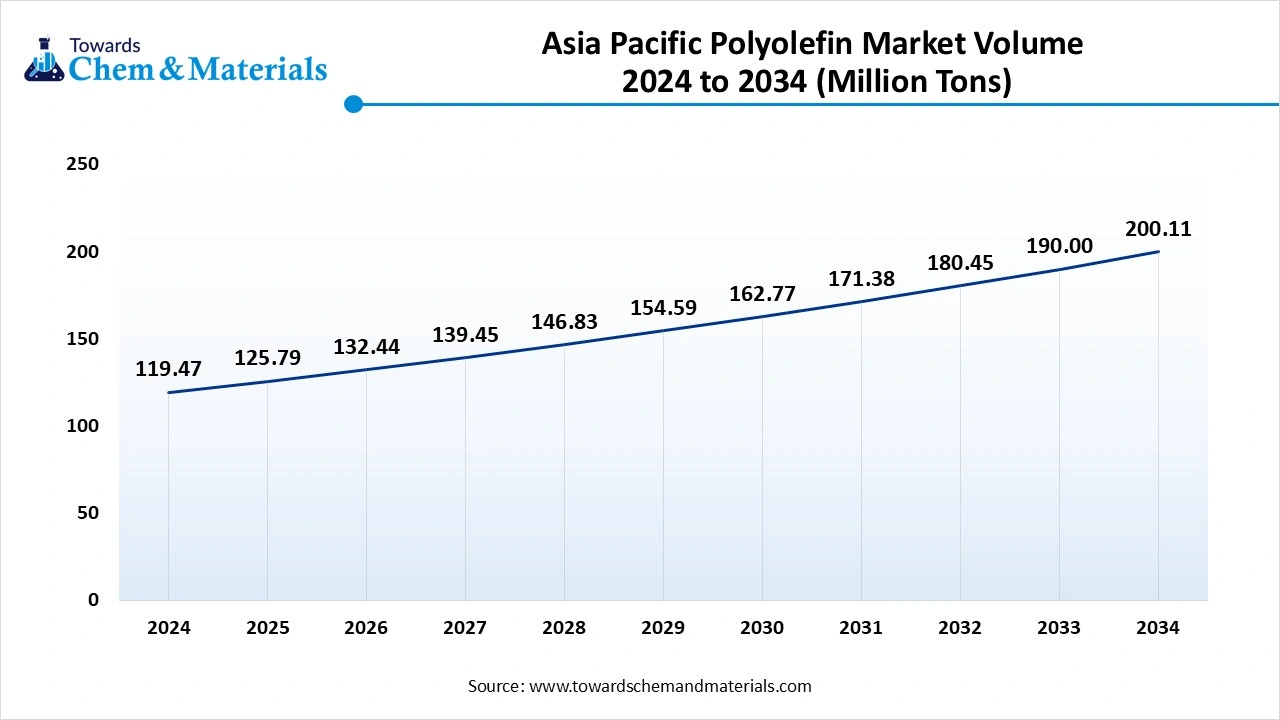

- The Asia Pacific polyolefin market size reached a volume of 119.47 million tons in 2025, the market is further projected to grow at a CAGR of 5.29% between 2025 and 2034, reaching a volume of 200.11 Million Tons by 2034.

- Asia Pacific dominated the market and accounted for a largest volume share of 51.78% in 2024.

- The Europe has held volume share of around 18.50% in 2024.

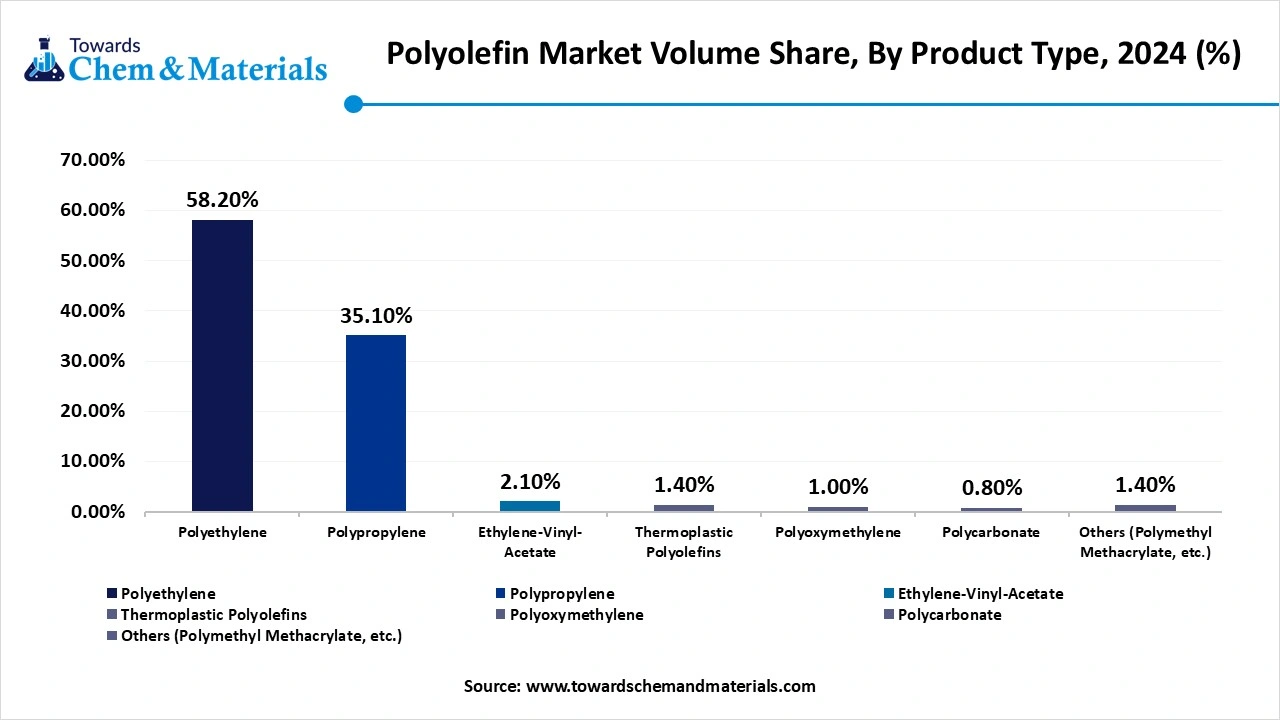

- The Polyethylene (PE) led the polyolefin market across the product segmentation and accounted for a largest volume share of 58.20% in 2024.

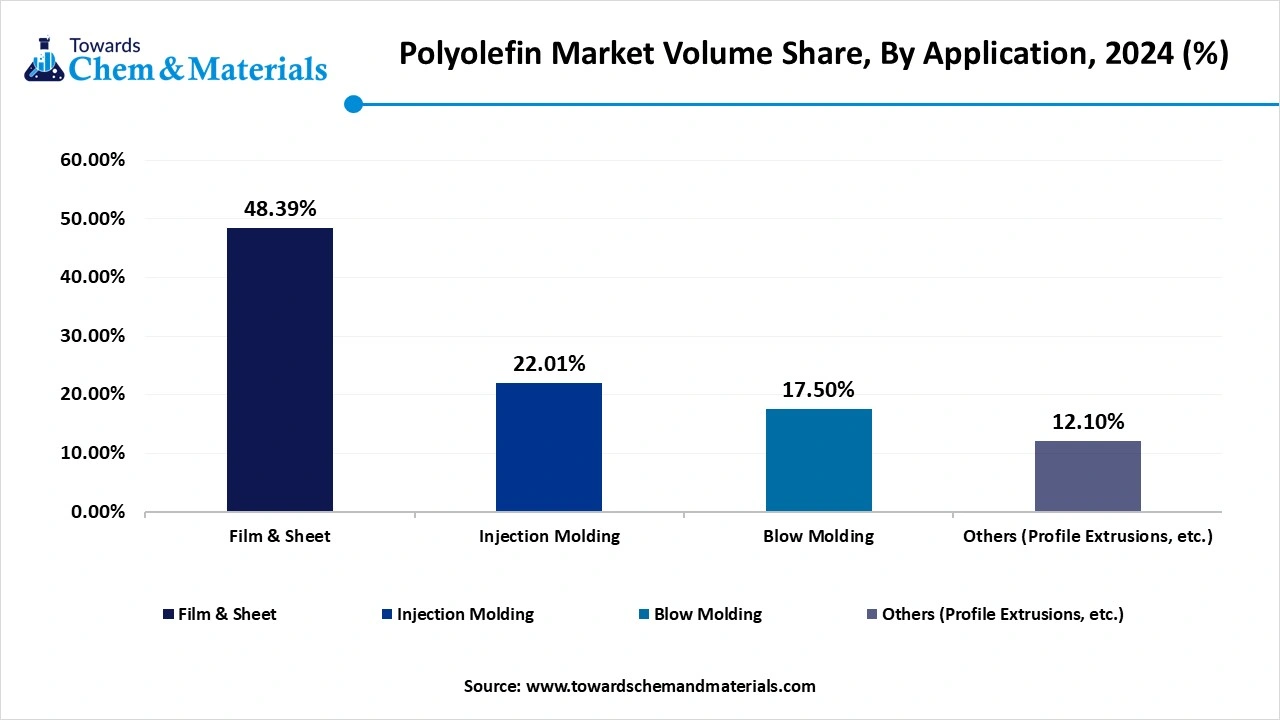

- The film & sheet led the market for polyolefin market across the application segmentation and accounted for a largest volume share of 48.39% in 2024.

Explore Strategic Figures & Forecasts – Access the Databook | Immediate Delivery Available: https://www.towardschemandmaterials.com/download-databook/5596

Properties of polyolefins

There are four types of polyolefins:

- LDPE (low-density polyethylene) is defined by a density range of 0.910 0.940 g/cm3. It can withstand temperatures of 80°C continuously and 95°C for a short time. Made in translucent or opaque variations, it is flexible and tough.

- LLDPE (linear low-density polyethylene) is a substantially linear polyethylene, with significant numbers of short branches, commonly made by copolymerisation of ethylene with longer-chain olefins. LLDPE has higher tensile strength and higher impact and puncture resistance than LDPE. It is very flexible and elongates under stress. It can be used to make thinner films and has good resistance to chemicals. It has good electrical properties. However, it is not as easy to process as LDPE.

- HDPE (high-density polyethylene) is known for its large strength-to-density ratio. The density of HDPE can range from 0.93 to 0.97 g/cm3 or 970 kg/m3. Although the density of HDPE is only marginally higher than that of low-density polyethylene, HDPE has little branching, giving it stronger intermolecular forces and tensile strength than LDPE. It is also harder and more opaque and can withstand higher temperatures (120°C for short periods).

- PP (polypropylene) is the commodity plastic with the lowest density, between 0.895 and 0.92 g/cm³. Compared to polyethylene, it has superior mechanical properties and thermal resistance but less chemical resistance. PP is usually tough and flexible, especially when copolymerised with ethylene.

How polyolefins are used

The specific qualities of each type of polyolefin lend them to differing applications:

- LDPE: cling film, carrier bags, agricultural film, milk carton coatings, electrical cable coating, heavy-duty industrial bags

- LLDPE: stretch film, industrial packaging film, thin-walled containers, and heavy-duty, medium and small bags

- HDPE: crates and boxes, bottles (for food products, detergents, cosmetics), food containers, toys, petrol tanks, industrial wrapping and film, pipes and houseware

- PP: food packaging, including yoghurt, margarine pots, sweet and snack wrappers, microwave-proof containers, carpet fibres, garden furniture, medical packaging and appliances, luggage, kitchen appliances, and pipes

Applications of polyolefins

The specific qualities of the various types of polyolefins lend themselves to differing applications, such as:

- LDPE: cling film, carrier bags, agricultural film, milk carton coatings, electrical cable coating, heavy duty industrial bags.

- LLDPE: stretch film, industrial packaging film, thin-walled containers, and heavy-duty, medium and small bags.

- HDPE: crates and boxes, bottles (for food products, detergents, cosmetics), food containers, toys, petrol tanks, industrial wrapping and film, pipes and houseware.

- PP: food packaging, including yoghurt, margarine pots, sweet and snack wrappers, microwave-proof containers, carpet fibres, garden furniture, medical packaging and appliances, luggage, kitchen appliances, and pipes.

Polyolefin Market Report Scope

| Report Attribute | Details |

| Market Volume on 2025 | 241.98 Million Tons |

| Expected Volume by 2034 | 371.54 Million Tons |

| Growth Rate | CAGR of 4.88% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2018 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in kilotons, revenue in USD million, and CAGR (%) from 2025 to 2034 |

| Report coverage | Revenue and volume forecast, company profiles, competitive landscape, growth factors, and trends |

| Segments covered | Product, application, region |

| Key companies profiled | China Petrochemical Corporation; LyondellBasell Industries Holdings B.V.; PetroChina Company Limited; TotalEnergies; Chevron Corporation; Repsol; Dow, Inc.; Exxon Mobil Corporation; Braskem; and Borealis AG |

What are the Major Trends in the Polyolefin Market?

Shift Towards Bio-Based Polyolefins- There is a movement across the sector to address sustainability targets and similar pressures through bio-based polyolefins.

Growth Demand from Flexible Packaging Sector- There is strong demand for polyolefins from the flexible packaging industry, due to its lightweight, durable and moisture resistant qualities. Its versatility supports an increasing range of applications for food packaging, personal care and shipping in the e-commerce sector, making it an ideal choice for manufacturers looking for cost-effective and recyclable options.

Growing Adoption of Recycled Polyolefins- Global circular economy policies are helping to drive the adoption of recycled polyolefins. Companies such as Borealis and LyondellBasell are investing in chemical recycling technologies to produce high-purity recycled polymers for use in automotive, construction, and electronics, which will help companies manage regulatory compliance issues and sustainability branding initiatives.

AI Implementation on the Polyolefin Market

Artificial Intelligence (AI) is becoming a strategic enabler in the polyolefin industry, driving efficiency, quality, and innovation across the value chain. AI-powered process optimization—using machine learning and data analytics—enables real-time monitoring and control of polymerization reactors. By analyzing sensor data and historical outputs, producers can fine-tune temperatures, pressures, and feed rates to maximize yields, reduce energy consumption, and minimize waste. In quality control, AI-driven “soft sensors” predict critical properties (e.g., molecular weight, melt index) more frequently and accurately than traditional lab tests, leveraging sparse real-time measurements paired with process data. Predictive maintenance systems, powered by anomaly detection and machine learning, anticipate equipment failures before they occur—significantly reducing downtime in continuous polyolefin plants. As AI adoption increases, the polyolefin industry is poised for smarter, more sustainable, and agile manufacturing—reshaping production economics and environmental impact.

Why Are Polyolefins Currently Attracting Significant Industrial Interest?

Polyolefins (e.g. polyethylene (PE), polypropylene (PP), ethylene-vinyl acetate (EVA) and thermo plastic polyolefins (TPO) are multitalented polymers used across many industries including automotive, agriculture, packaging and construction. They light weight, chemical resistance, and recyclable makes them attractive to many industries in the current manufacturing world. As the demand for sustainable and economical materials drive the market, polyolefin materials grow in importance in many higher-end sectors, Electric Vehicles, encapsulants for solar panels, and medical devices to name a few.

Emerging applications in biodegradable blends, and 3-D printing will only make polyolefin use more up and coming among users. Businesses are beginning to look at value-added products from their polyolefin use and are considering circular economies, therefore have educated requests for innovative proposals from producers, manufacturers, etc. The expanding role of polyolefin's marks an opportunity for a movement towards green, high-performance materials.

What’s Powering the Future of Polyolefin Market?

The polyolefin industry is entering a period of dynamic growth fueled by rapidly growing demand in the packaging, automotive and construction sectors. Polyethylene and polypropylene are preferred because they are lightweight and recyclable as producers react to global sustainability initiatives. The rise of electric vehicles has also heightened the need for polyolefins due to their thermal stability and member affordability.

The rapidly expanding infrastructure in both Asia and Africa is also driving uptake. Development in technology such as metallocene catalysts and bio-based production are enabling material performance improvements and regulatory compliance with sustainability initiatives. As manufacturers navigate evolving industry standards and sustainability mandates, polyolefins are increasingly being viewed as critical materials with the expectation of impactful growth through innovation over the next several years.

What Can be the Potential Barriers Limiting the Future Growth of Ammonia Market?

- Strict Environmental Regulations on Plastic Waste: The global hunt to address plastic pollution is a direct threat to polyolefins. According to the UN Environment Programme, only about 9% of plastic waste is brought to recycling globally. Increasing limitations including completely banning single-use plastics in the EU, India and select states in the U.S. are directly impacting consumption behaviors and forcing producers to invest in expensive recycling technologies and sustainable alternatives.

- Increased Competition from Bioplastics and Sustainable Alternatives: In a world where sustainability is the interest of policymakers and product consumers, bioplastics and biodegradable alternatives are displacing polyolefins at an accelerated pace. Major packaging brands are adhering to environmental social and governance (ESG) goals by moving towards compostable or plant-based polymers. According to the European Bioplastics, a global bioplastics market capacity of 7.5 million tons is projected for 2026 which will absolutely apply pressure to polyolefins.

For more information, visit the Towards Chem and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Why is Asia Pacific dominating the Global Polyolefin Market?

The Asia Pacific polyolefin market demand stood at 119.47 million tonnes in 2024 and is forecast to reach 200.11 million tonnes by 2034, growing at a healthy CAGR of 5.29% until 2034. Asia pacific is dominated polyolefin market in 2024. Asia Pacific dominated the polyolefin market in 2024. The growth of the market is attributed due to the wide industrial base, industrial development and demand from the construction and automotive industries. The region has an abundance of, inexpensive feedstock, large-scale production capabilities, and regional or national governments that are promoting industrial sectors in the region. Increased urbanization and infrastructure development in countries like India, Pakistan and Southeast Asia have fueled demand for polyolefin.

China is the leading country in the Asia Pacific polyolefin market, driven by strong industrial development and demand for polyolefin in China from industries such as automotive, food and beverage packaging. In addition, China recently put significant investment into major petrochemical complex development, which are intended to increase the regions self-reliance for petrochemical feedstock, but also increasing domestic production capabilities.

- In 2024, China imported 2.4 million tons of PE from the US. This accounted for 20% of its China’s PE imports.

Polyolefin Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Million Tons 2024 | Volume Share, 2034 (%) | Market Volume Million Tons 2034 | CAGR(2025 - 2034) | |||

| North America | 15.21 | % | 35.09 | 14.23 | % | 52.87 | 4.18 | % |

| Europe | 18.50 | % | 42.68 | 17.21 | % | 63.94 | 4.12 | % |

| Asia Pacific | 51.78 | % | 119.47 | 53.86 | % | 200.11 | 5.29 | % |

| Latin America | 5.50 | % | 12.69 | 5.20 | % | 19.32 | 4.29 | % |

| Middle East & Africa | 9.01 | % | 20.79 | 9.50 | % | 35.30 | 5.44 | % |

| Total | 100 | % | 230.72 | 100 | % | 371.54 | 4.88 | % |

What Makes North America the Fastest Growing Marketplace for Polyolefin Market?

North America is expected to expand fastest during the forecast period due to the availability of shale gas, which is a cheaper feedstock for polyolefin manufacturing. Recent developments and investments in petrochemicals in North America, especially the U.S., reflect the current growing capacity. Polyolefins are being used in many applications, which are often in lightweight forms to yield packaging plastics used in automotive, healthcare, and packaging - aiding innovation and the use or polyolefin beyond its traditional means.

U.S. Polyolefin Market Trend

The U.S. is leading in municipal growth due to the on-going petrochemical ecosystem and infrastructure capable of servicing exports. Elevated sustainability, polymer recycling, and developments in high-performance polymers continue to solidify the U.S.'s potential to remain dominant as a polyolefin supplier.

Polyolefin Market Segmentation Analysis:

By Product Insights

Which Product Segment Dominate the Polyolefin Market in 2024?

Polyethylene (PE) segment dominated the polyolefin market in 2024. It is widely used in packaging, construction, agriculture and consumer goods. Its advantageous properties can be identified by the excellent chemical resistance, durability, and flexibility. Their property has made it a material of choice when it comes to film & sheet applications and is dominant in films for food and beverage packaging. High-density polyethylene (HDPE) and low-density polyethylene (LDPE) will dominate the industrial containers, plastic bags and stretch films.

Polypropylene (PP) segment expects the fastest growth in the polyolefin market during the forecast period, with its high fatigue resistance, lightweight and low costs. The expected upsurge in electric vehicles, lightweighting in transportation and changes in automotive parts, textiles and medical applications, as well as new developments in PP foam and random copolymers for rigidity packaging and consumer good products is all consuming increased quantities of PP.

Polyolefin Market Volume Share, By Product Type, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume Million Tons 2024 | Volume Share, 2034 (%) | Market Volume Million Tons 2034 | CAGR(2025 - 2034) | |||

| Polyethylene | 58.20 | % | 134.28 | 55.40 | % | 205.83 | 4.36 | % |

| Polypropylene | 35.10 | % | 80.98 | 36.80 | % | 136.73 | 5.38 | % |

| Ethylene-Vinyl-Acetate | 2.10 | % | 4.85 | 2.40 | % | 8.92 | 7.01 | % |

| Thermoplastic Polyolefins | 1.40 | % | 3.23 | 1.70 | % | 6.32 | 7.74 | % |

| Polyoxymethylene | 1.00 | % | 2.31 | 1.10 | % | 4.09 | 6.56 | % |

| Polycarbonate | 0.80 | % | 1.85 | 1.10 | % | 4.09 | 9.23 | % |

| Others (Polymethyl Methacrylate, etc.) | 1.40 | % | 3.23 | 1.50 | % | 5.57 | 6.25 | % |

| Total | 100 | % | 230.72 | 100 | % | 371.54 | 4.88 | % |

Application Insights

Which Application Segment Holds The Largest Proportion Of Polyolefin Consumption Across Industries?

The film & sheet segment dominated the market in 2024, due to increased usage in food packaging, agriculture films, and industrial stretch wraps. Many consumers have turned to multi-layer barrier films based on PE and PP as they allow longer shelf life of products and may be less expensive than alternatives. The upsurge in e-commerce and increasing demand for flexible packaging has triggered this upward trend in the film and sheet segment.

The injection molding expects the fastest growth in the market during the forecast period, mainly owing to the greater demand of automotive, electronics, and healthcare. Polyolefins such as PP and PE are perfect for injection molding because of their ability to create lightweight forms with complex geometries and allow for high processability. The global movement toward modular medical devices and personalized healthcare packaging has further escalated the uptake of injection molded polyolefins.

Polyolefin Market Volume Share, By Application, 2024-2034 (%)

| By Application | Volume Share, 2024 (%) | Market Volume Million Tons 2024 | Volume Share, 2034 (%) | Market Volume Million Tons 2034 | CAGR(2025 - 2034) | |||

| Film & Sheet | 48.39 | % | 111.65 | 46.00 | % | 170.91 | 4.35 | % |

| Injection Molding | 22.01 | % | 50.78 | 23.80 | % | 88.43 | 5.70 | % |

| Blow Molding | 17.50 | % | 40.38 | 18.20 | % | 67.62 | 5.90 | % |

| Others (Profile Extrusions, etc.) | 12.10 | % | 27.92 | 12.00 | % | 44.58 | 5.34 | % |

| Total | 100 | % | 230.72 | 100 | % | 371.54 | 4.88 | % |

More Insights in Towards Chem and Materials:

- Polyamide Market : The global polyamide market size is calculated at USD 44.85 billion in 2024, grew to USD 47.07 billion in 2025 and is predicted to hit around USD 72.71 billion by 2034, expanding at healthy CAGR of 4.95% between 2025 and 2034. In 2024, Asia-Pacific was the leading region in the Polyamide sector, holding more than 44.85% of the market share, with revenues totaling approximately USD 20.12 billion

- Polyester Resin Dispersion Market : The global polyester resin dispersion market size is expected to increase from USD 9.79 billion in 2024, grew to USD 10.20 billion in 2025 and is predicted to hit around USD 14.70 billion by 2034, expanding at healthy CAGR of 4.15% between 2025 and 2034.

- Polysilicon Market : The global polysilicon market size was estimated at USD 42.98 billion in 2024 and is predicted to increase from USD 49.90 billion in 2025 to approximately USD 191.24 billion by 2034, expanding at a CAGR of 16.10% during the forecast period from 2025 to 2034.

- Per- and Polyfluoroalkyl Substances (PFAS) Chemicals Market : The global per- and polyfluoroalkyl substances (PFAS) chemicals market volume is calculated at 788.70 thousand tons in 2024, grew to 832 thousand ton in 2025, and is projected to reach around 1,347.10 thousand tons by 2034.

- Polyethylene Market : The global polyethylene market volume reached 113.2 million tons in 2024 and is projected to hit around 158.1 million tons by 2034, expanding at a CAGR of 3.40% during the forecast period from 2025 to 2034.In 2024, Asia Pacific held a dominant market position, capturing more than a 45.5% share and holding a 51.5 million tons market volume for the year.

- Low-Density Polyethylene (LDPE) Market : The global low-density polyethylene (LDPE) market size was accounted for USD 44.86 billion in 2024, grew to USD 47.55 billion in 2025 and is expected to be worth around USD 80.34 billion by 2034, poised to grow at a CAGR of 6% between 2025 and 2034.

- Water Treatment Polymers Market : The global water treatment polymers market volume was estimated at 8,323.1 kilotons in 2024 and is predicted to increase from 8,855.8 kilotons in 2025 to approximately 15,477.5 kilotons by 2034, expanding at a CAGR of 6.40% from 2025 to 2034.

- Mechanical & Chemical Recycling of Polyethylene Market : The global mechanical & chemical recycling of polyethylene market was valued at approximately USD 17.35 billion in 2024 and is projected to grow at a CAGR of 10.29% from 2025 to 2034, reaching a value of USD 46.20 billion by 2034. Sustainability initiatives by global governments and increased need for recycled

- Polystyrene Market :The global polystyrene market volume was 40.09 million tons in 2024 and is projected to grow from 41.09 million tons in 2025 to 62.33 million tons by 2034, exhibiting a CAGR of 4.51% during the forecast period.

- Fluoropolymers Market : The global fluoropolymers market volume is calculated at 639.21 kilo tons in 2024, grew to 688.89 kilo tons in 2025 and is predicted to hit around 1351.23 kilo tons by 2034, expanding at healthy CAGR of 7.77% between 2025 and 2034. In 2024, Asia Pacific led the market, achieving over 48.50% volume share with a volume of 639.21 Kilo Tons

- Polymer Modified Bitumen Market : The global polymer modified bitumen market volume was 25.70 million tons in 2024 and is projected to grow from 26.86 million tons in 2025 to 39.90 million tons by 2034, exhibiting a CAGR of 4.50% during the forecast period. Asia Pacific dominated the market with market volume share of 44.31% in 2024.

- Fiber Reinforced Polymer Composites Market : The global fiber reinforced polymer composites market size accounted for USD 111.01 billion in 2025 and is forecasted to hit around USD 196.50 billion by 2034, representing a CAGR of 6.55% from 2025 to 2034. In 2024, North America dominated the fiber reinforced polymer composites market with a market share of 37.16% in 2024.

- Polyolefin Sheets in Industrial Market : The global polyolefin sheets in industrial market size accounted for USD 8.49 billion in 2024, grew to USD 8.99 billion in 2025, and is expected to be worth around USD 14.99 billion by 2034, poised to grow at a CAGR of 5.85% between 2025 and 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 48.34% share and holds a USD 4.10Billion market value for the year.

- Polyether Ether Ketone Market : The global polyether ether ketone market size was valued at USD 849.10 million in 2024 and is estimated to hit around USD 1,851.90 million by 2034, growing at a compound annual growth rate (CAGR) of 8.11% during the forecast period 2025 to 2034.

Top 10 Companies in Polyolefin Market & Their Contributions

- Borealis AG – Beyond its core polyolefin production, Borealis drives circular innovation with technologies like Borcycle™ and its Bornewables™ portfolio—producing high-quality polyolefins from renewable and recycled feedstocks to reduce lifecycle emissions.

- Braskem – As the Americas’ leading thermoplastic resin producer, Braskem spearheads sustainable solutions through its expansion of green polyethylene derived from sugarcane ethanol and its Möbius dissolution-based recycling partnership with TNO .

- Chevron Corporation (via Chevron Phillips Chemical) – Through CPChem, Chevron offers a broad portfolio of polyolefins—including polyethylene, alpha-olefins, and specialty plastics—serving applications from piping to packaging and driving significant value in petrochemical integration .

- China Petrochemical Corporation (Sinopec) – Sinopec’s integrated polyolefin production leverages its vast refining and petrochemical infrastructure across China, providing reliable, large-scale PE and PP supply to domestic and global markets (linked to Asian petrochemical dominance) .

- Dow, Inc. – Dow strengthens circular economy efforts in packaging by pioneering recyclable label adhesives and advancing innovative co-polyolefin technologies that enhance recycling and material recovery .

- Exxon Mobil Corporation – ExxonMobil’s Exact™ polyolefin elastomers bridge the gap between plastics and rubber, offering enhanced flexibility, toughness, and recyclability in packaging, automotive, wire, and cable applications .

- LyondellBasell Industries – As the world’s largest licensor of polyethylene and polypropylene technologies, LyondellBasell delivers a vast polyolefin resin and compounds portfolio—including its Circulen™ sustainable solutions and specialized products like polybutene-1 for piping .

- PetroChina Company Limited – PetroChina capitalizes on its downstream capacity (e.g., the Fushun Petrochemical complex) to produce high-volume HDPE and PP, supporting both domestic infrastructure projects and export markets .

- Repsol – Repsol significantly scaled its circular polyolefin line by investing €26 million in its Puertollano plant to boost Reciclex® recycled PE and PP production—aiming to recycle 20% of its polyolefins by 2030 .

- TotalEnergies – TotalEnergies offers advanced polyolefin grades for rigid packaging—like its Lumicene® and HDPE Caps & Closures range—optimized for lighter weight, improved mechanical properties, and better recyclability .

What is Going Around the Globe in Radiopharmaceutical Market?

- In June 2025, Clariant launches AddWorks PPA, an PFAS-free polymer processing aids for more sustainable polyolefin extrusion. These PFAS-free solutions support recyclability requirements under the upcoming EU Packaging and Packaging Waste Regulation (PPWR), further aligning with the industry's sustainability objectives.

- In May 2025, In May 2025 Taghleef Industries launched SHAPE360® TDSW, a white floatable polyolefin shrink sleeve film that provides good opacity and recyclability. With the introduction of SHAPE360® TDSW Taghleef has augmented its sustainable SHAPE360® label range alongside the clear SHAPE360® TDS.

-

In February 2025, Innovia Films has announced the launch of the next-generation shrink sleeve made out of recycling-friendly polyolefin (PO) material. This sleeve is crafted from a low-density polyolefin material that floats, facilitating the essential sink/float separation process in PET recycling.

Polyolefin Market Top Key Companies:

- China Petrochemical Corporation

- LyondellBasell Industries Holdings B.V.

- PetroChina Company Limited

- TotalEnergies

- Chevron Corporation

- Repsol

- Dow, Inc.

- Exxon Mobil Corporation

- Braskem

- Borealis AG

Polyolefin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chem and Materials has segmented the global Polyolefin Market

By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Ethylene-Vinyl Acetate (EVA)

- Thermoplastic Polyolefins (TPO)

- Polyoxymethylene (POM)

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Others

By Application

- Film & Sheet

- Injection Molding

- Blow Molding

- Profile Extrusion

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5596

About Us

Towards Chem and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.